This world needs more tech innovations and investments to solve the most important challenges. It’s tough to build or evaluate tech startups in deep trenches of industry contexts, collaboration is needed. We connect select startups/scaleups, industry leaders, corporate innovators, ecosystem partners, accelerators, and investors (angels, VCs, CVCs, Family Offices) for impactful investing and venturing. Angels can form SPVs to invest together, VCs can invest directly.

- We select startups from top seed investors or recommendations from our advisors and GPs. All fellows can engage in evaluation.

- The first step is to analyze the methods and processes of deal sources to confirm they are sound.

- We collaborate across boundaries to accumulate data, across geographies for global opportunities.

- Through this method, our fellows can get more insights and data into startups.

- We love to support strategic angels or seed-stage specialized fund managers.

- Collective intelligence is built by asynchronous or synchronous methods with a digital platform.

- Many investors in this network are experienced startup advisors, venture-builder VCs, industry experts and executives who can offer industry knowledge, add value, and make introductions.

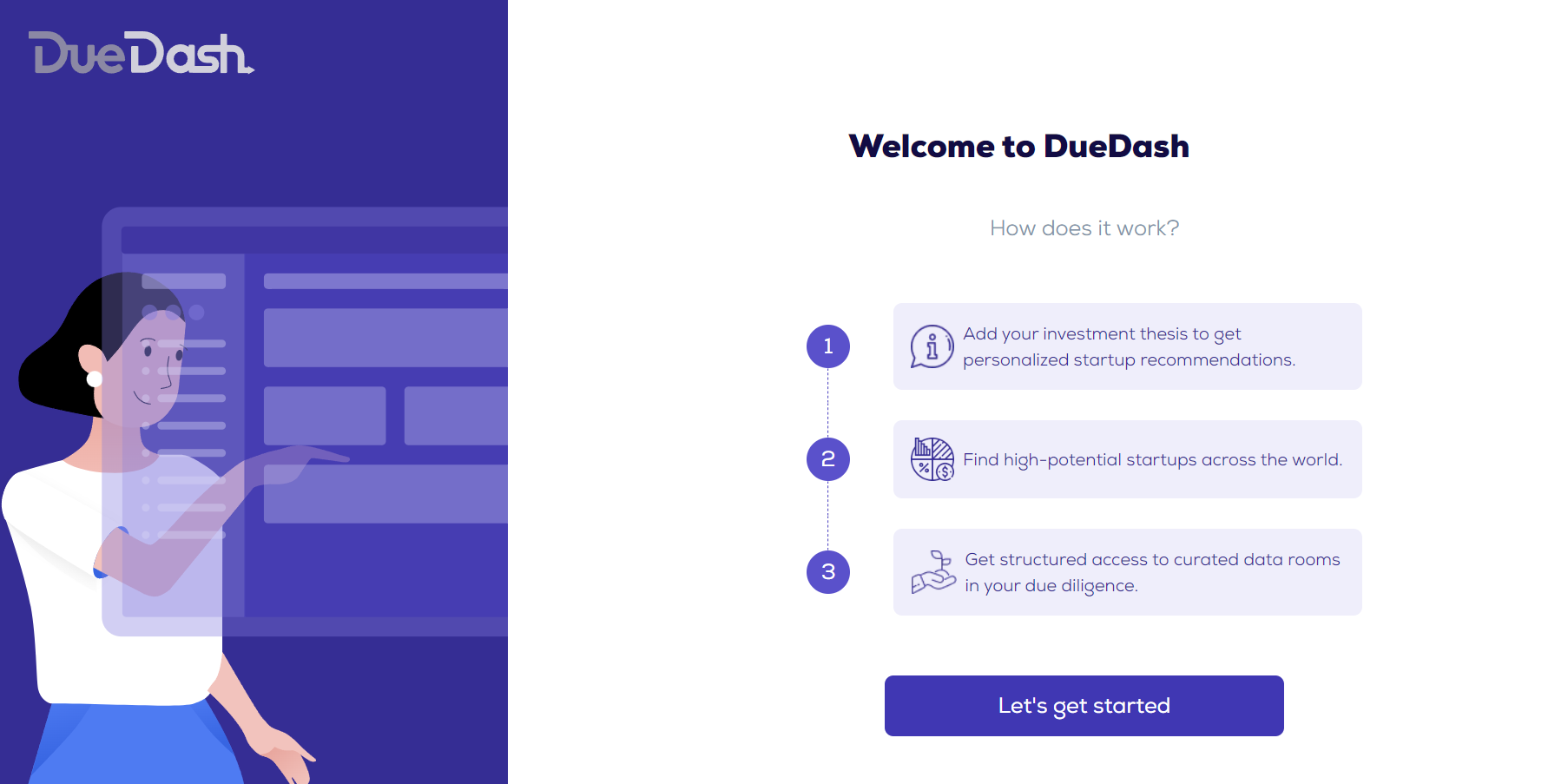

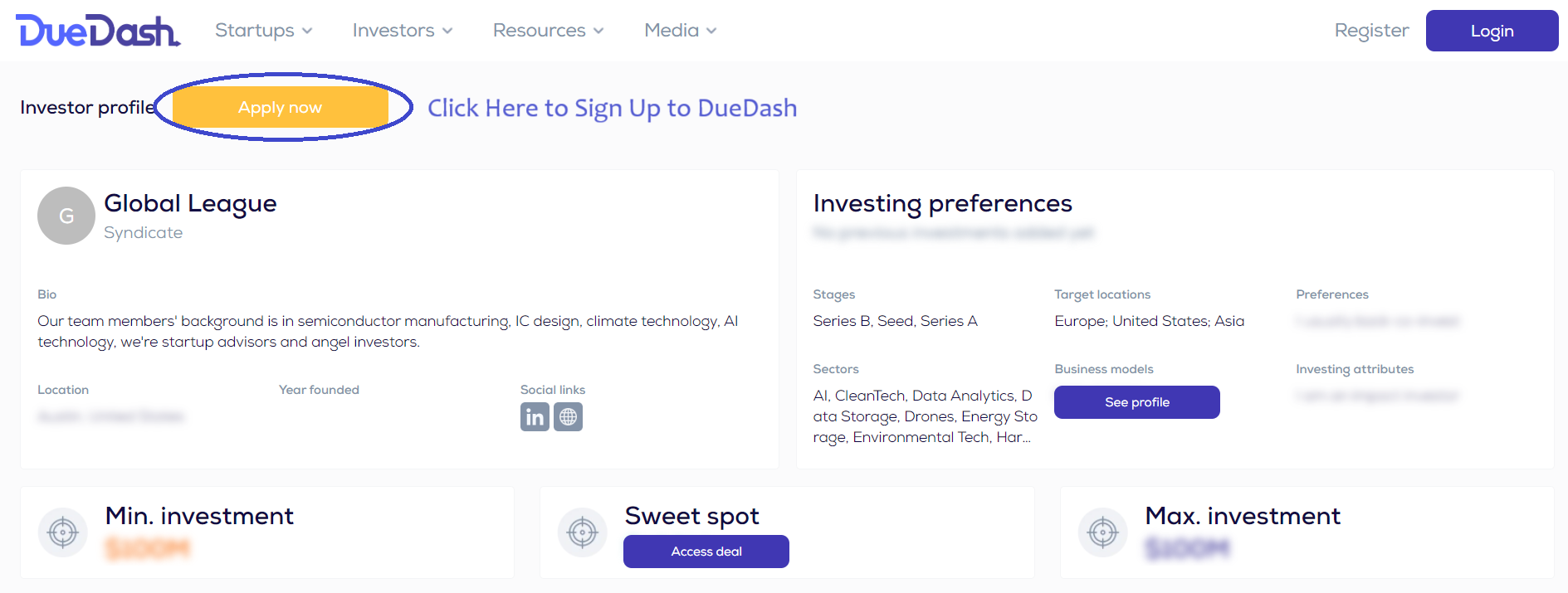

To support our mission more efficiently, we partner with DueDash for a network effect, about 2000 investors and 3000 startups are on the platform now. The values of our collaboration with DueDash to offer for investors are:

-

Streamline our process and automate some steps from end to end across boundaries,

-

Get deal recommendations by data matching,

-

Deal sharing on the platform with thousands of VCs, FOs and angels,

-

Structured workflow for deal screening and evaluation with a framework used by top VCs,

-

Communications step by step with startups and fellows, in one place,

-

Collaboration within or outside our group with experts needed in the evaluation,

-

Due diligence with curated documents/reports and collective intelligence,

-

Deal pipeline management (before investing) and portfolio management (after investing),

-

Key metrics reporting and regular updates from startups,

-

Startup tracking and data analytics,

-

Showcase you as an investor, make your thesis and portfolio visible to thousands of startups, and LPs, you have total control of visibility and access,

-

Investors can invite startups to help them raise, values for startups: fundraising guidance, investment-ready assessment, connecting investors, investor updates, investor relations management, etc.