Here below we select first-order signals from the 2023 annual report created by Net Zero Insights – a data and research platform for Climate Tech.

ClimateTech Year 2023 Review

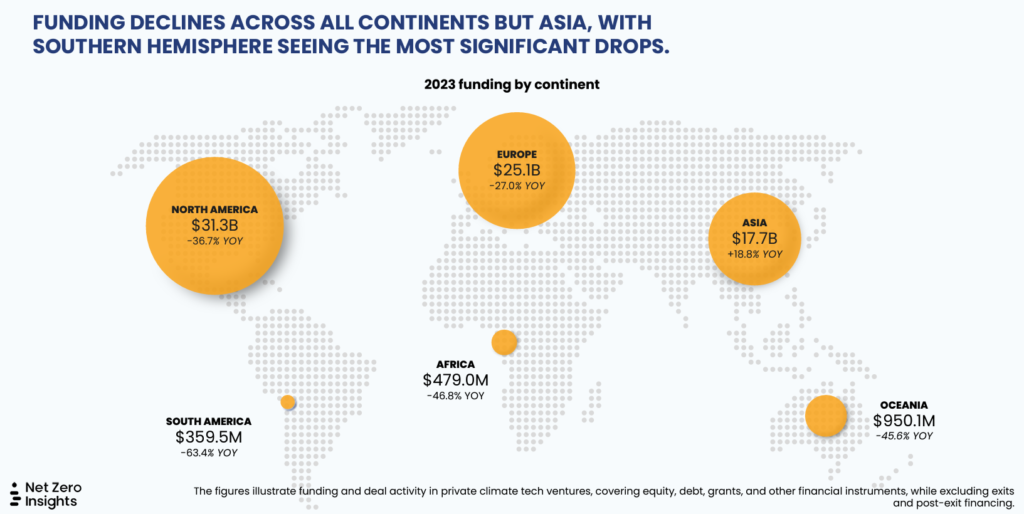

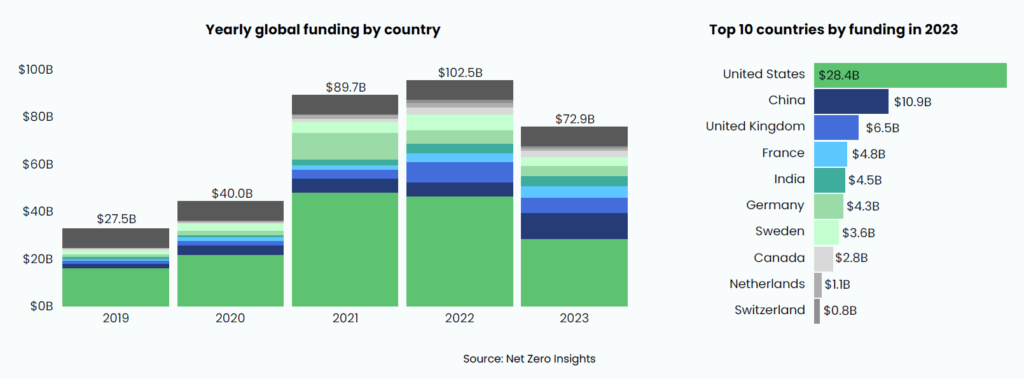

In 2023, the two-year funding boom concluded with a significant 30% YoY drop. Despite a challenging year, the funding landscape holds promise with growth surpassing 2018 (2.76X) and 2020 (2X). Funding slows globally, except for Asia (+19% YOY). Europe is more resilient than North America.

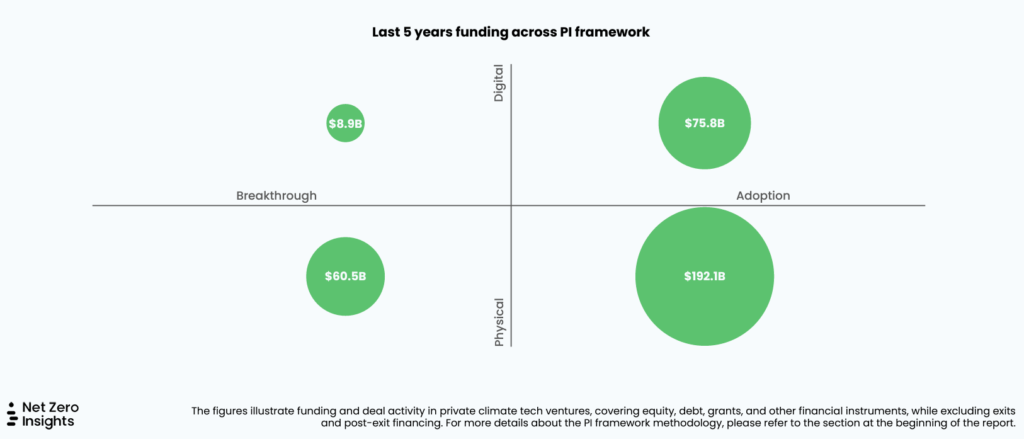

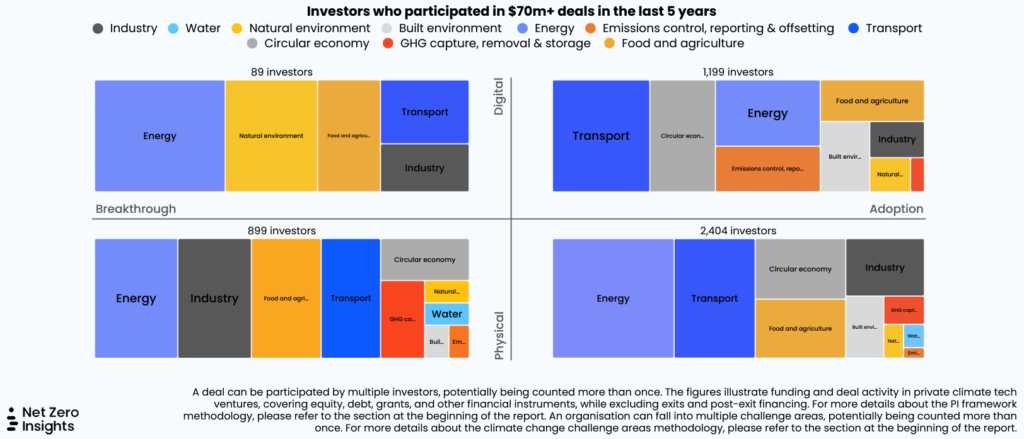

Net Zero Insights uses a product innovation framework: “Breakthrough” innovation entails extensive research and development, characterized by long-term efforts and innovations in the proof-of-concept phase. “Adoption” concentrates on implementing and deploying established solutions, with a focus on improving metrics like cost or efficiency. While “physical” and “digital” represent what the company builds.

80% of all venture funding raised in the last 5 years across equity, debt, and grants went to adoption. Of this, 70% went to physical solutions, with most of it being non-dilutive. Note: Breakthrough solutions in the US secure over twice the funding compared to Europe. ($4.7B vs $2.5B)

The path to a net-zero economy demands readily deployable physical solutions and later-stage investors and lenders seem increasingly prepared to support it. First-of-a-Kind (FOAK) projects gained prominence last year but still pose challenges in definition and present funding complexities. In 2023, funding flowed towards adoption-focused innovations and later stages, indicating the increasing maturity of the market.

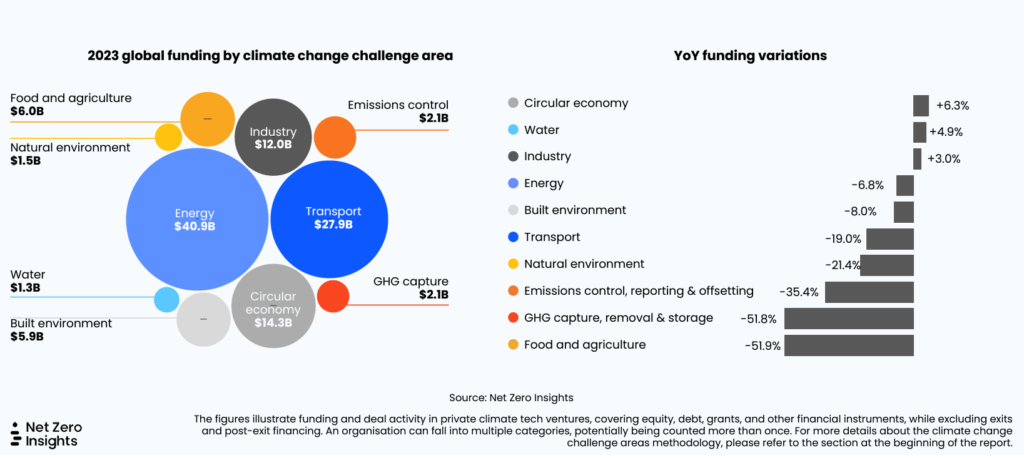

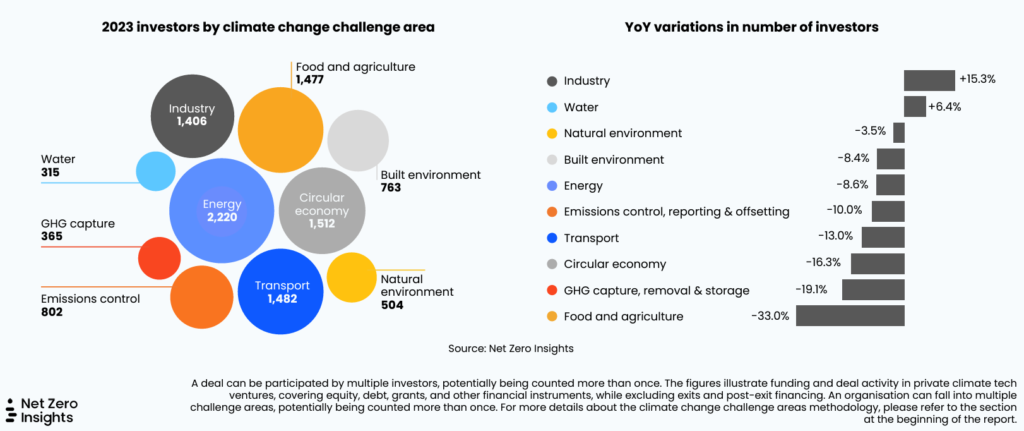

Circular economy, water, and industry are the only challenge areas to see positive YOY growth.

Energy attracts the largest investor base, while interest in industry and water is on the rise.

Overall, energy and transport are the most mature sub-sectors with the most funding and investors in the past 5 years. Circular economy, water, and industry are active emerging sub-sectors with obvious growth in seed and early-stage investments.

Companies headquartered in the US, China, and UK raised the most funding in 2023.

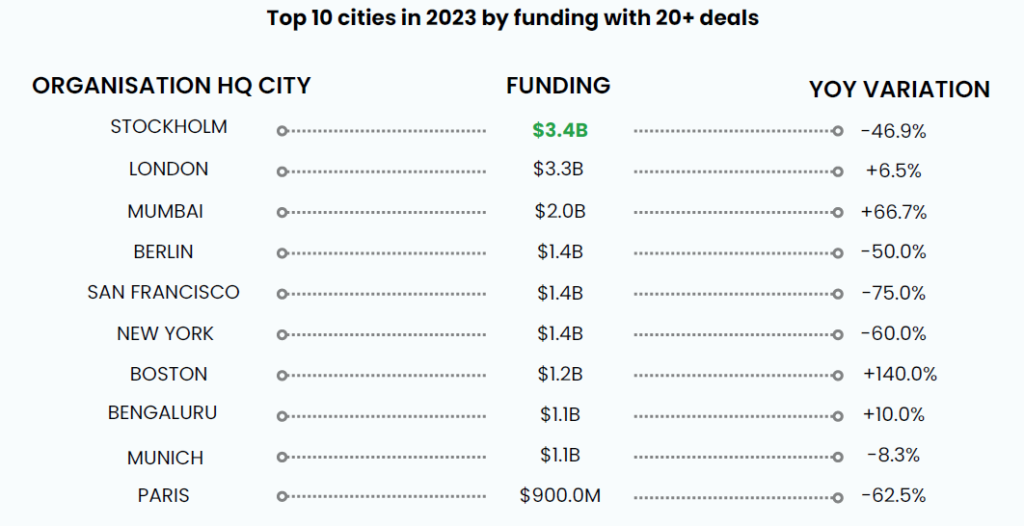

The top 10 most funded cities show a signal about the strength of cities.

In 2023, acquisitions reached a historic high (250 deals), predominantly in the energy, transport, and food & agriculture sectors while IPOs and SPACs returned to pre-pandemic levels. Acquisitions are gaining movement with corporate buyers.

Corporations exhibit resilience and sustained activity in Climate Tech M&A in the downturn. Corporate investments are concentrated in energy, food and agriculture, and transport, despite a slight decrease in funding in some of these sectors. Energy, industrials, and IT emerge as the predominant sectors among corporate acquirers, showcasing their strategic focus and interest in climate tech organizations.

Venture investors have a clear preference on digital types of solutions, funding them regardless of breakthrough or innovation.

Non-equity investors are not only intensifying their funding efforts but are also gaining prominence, particularly in later-stage deals.

Governmental funding is assuming an ever-growing significance in shaping current climate tech dynamics, particularly fostering breakthrough innovations.

Look at the number of investors, most investors favor adoption in energy and transport, with a busier-than-expected scene in physical breakthroughs.

The above is just extracting a part of the annual climate tech report, dive in for deeper insights in the report here from Net Zero Insights.

Are Water Innovations On Your Radar?

Water innovation startups may be underinvested, as water remains one of the most undervalued and underinvested resources in agrifood innovation, despite its intrinsic role in the food system. However, there are signs that this trend is changing, with more than 18 ocean-focused funds being launched in the last 18 months. Public investments are also on the rise, such as the Inflation Reduction Act in the US and initiatives from the World Bank. The Valuing Water Finance Initiative aims to convince the world’s largest corporates to treat water as a valuable resource, representing 64 institutional investors with a total of $9.8 trillion in assets under management. (source)