In May 2025, President Trump visited the Middle East and signed memoranda of understanding (MOUs) for trillions of dollars to be invested in or to purchase from US companies over the next few years. Investing in the US, especially in advanced manufacturing related to US national security, is the most effective way to negotiate tariffs. Many international companies are unaware of the government resources available to companies investing in the US, as well as the opportunities for US investors to participate in this trend with significant tax benefits.

The United States has a vast number of local government entities. In 2022, the total count of U.S. local governments, encompassing county, township, municipal, and special-purpose entities, was 90,837. A survey by the International City/County Management Association found that 95% of U.S. local governments offer some form of tax-related incentives. That means over 85,000 of these entities provide such inducements. According to an investigation by the New York Times, it’s hard to calculate the total amount offered by all governments, but at least tens of billions are spent each year. These facts underscore the competitive landscape for business attraction across the nation.

Many international companies are leveraging this competition to negotiate resources from governments before they decide to land in the US. Experienced site selection consultants typically have the data on strengths, weaknesses, and priorities of various governments, and can simultaneously request proposals and negotiate with hundreds of them to secure the best terms by creating competition. We help international companies get the best government resources, combined with other kinds of options such as raising from private equity investors or debt financing.

Government incentives could include, but are not limited to:

Tax Credits: Reductions in tax liability for job creation, investment, or specific activities.

Tax Abatements/Exemptions: Forgiveness or reduction of property, sales, or other taxes for a defined period.

Special Tax Zones:

- Enterprise Zones: Designated geographic areas where businesses can receive various tax benefits, grants, and other incentives for locating or expanding. For instance, Virginia offers cash grants for investments in Enterprise Zones.

- Opportunity Zones (OZ):

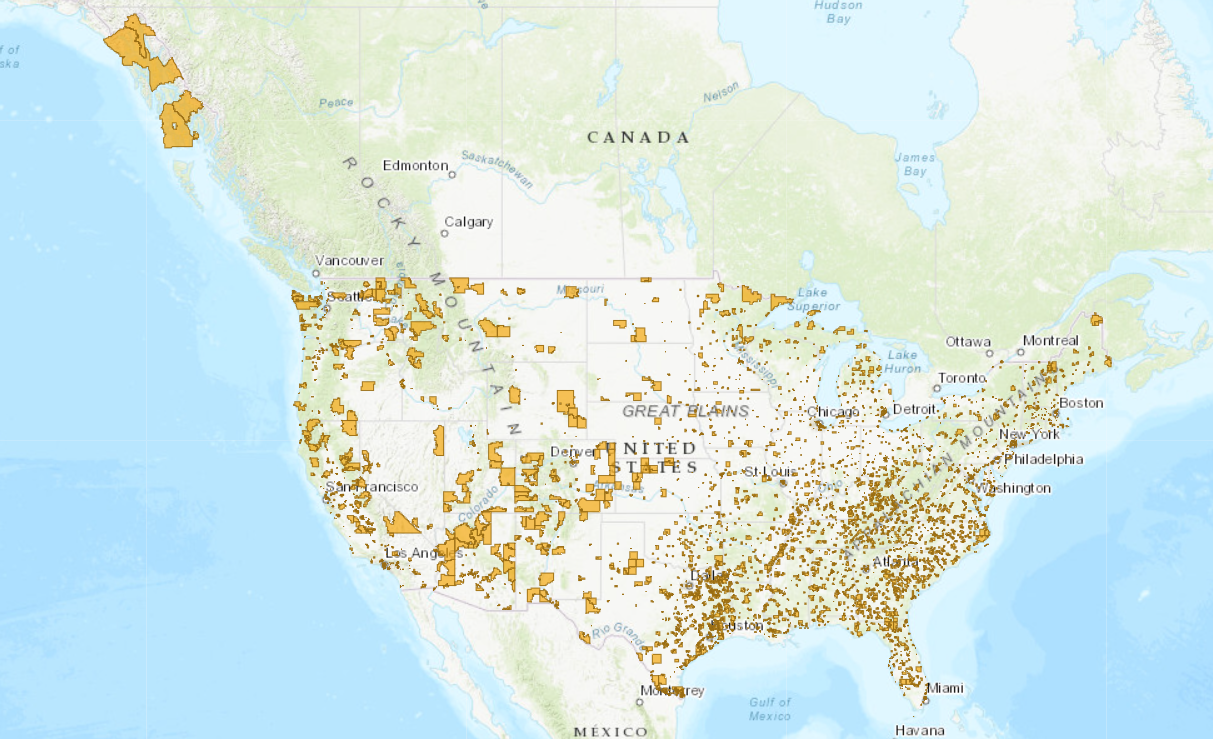

- A federal program with state and local coordination, offering tax incentives for investments in economically distressed communities. The Opportunity Zone tax incentive was enacted as part of the Tax Cuts & Jobs Act (TCJA) of 2017.

- U.S. taxpayers with capital gains who reinvest eligible gains in Qualified Opportunity Funds (which primarily invest in companies in Opportunity Zone regions) will receive tax deferrals. Once an investor achieves a 10-year holding period within an Opportunity Zone investment, the gain from the sale of the investment is 100% tax-free.

- By the end of 2022, OZs had attracted $100 billion in equity investments. There are 8,764 Opportunity Zones, located in urban, suburban, and rural areas in every major city in the US.

- In what President Trump called “The One, Big Beautiful Bill,” there is the “Renewal and Enhancement of Opportunity Zones” – the first formal OZ 2.0 legislative text to keep the policy alive beyond its scheduled sunset on Dec. 31, 2026.

- Free Zones (relevant for international trade): While often associated with ports or international trade, some local areas may benefit from proximity to or integration with free zones, offering benefits like 100% foreign ownership and no import/export duties.

Grants: Direct cash payments for capital investment, job creation, or infrastructure development.

Loans: Federal programs, such as the USDA Rural Development Business Loan Programs and the State Small Business Credit Initiative (SSBCI), provide loans to states. States also create their own loan programs with favorable terms, including zero-interest loans.

Workforce Development: Customized training programs to ensure a skilled labor pool.

Infrastructure Improvements: Investments in roads, utilities, or other public works to support a new or expanding business.

Subsidized Resources: Free or discounted land or working spaces; discounted utility rates.

Expedited Permitting and Regulatory Assistance: Fast-track permitting processes and assistance in navigating local regulations, saving companies time and resources.

Partnerships with Private Investors: Governments often engage in direct financial collaborations with private investors, including joint equity investments and matching funds, particularly for early-stage ventures or strategic industries.

State governments usually have more systematic programs. Many local government incentive packages are discretionary, meaning they are negotiated on a case-by-case basis rather than being automatically available through a statutory program. This allows local governments to tailor incentive packages to attract high-value projects from international companies. These can include “deal-closing funds” when competing with other locations. Creating competitions is key.

Local and state governments often target incentives toward strategic sectors such as advanced manufacturing, semiconductors, renewable energy, automotive, and life sciences. For example, South Carolina’s automotive cluster was significantly boosted by incentives offered to BMW. States like Texas and Florida provide local incentives tailored to industries like renewable energy and advanced manufacturing.

These priorities of the Trump administration will be highly desirable to state and local governments:

- American manufacturing renaissance: This includes advanced semiconductors, defense hard tech, space and satellite technologies, and robotics.

- AI superiority and alliance: This encompasses modern and next-generation computing infrastructure, making quantum computing a crucial component.

- Energy dominance encompasses both fossil fuels and clean energies. Nuclear and geothermal are welcomed by the Trump administration.

Examples:

- On April 9, President Trump issued a new Executive Order (EO) aimed at restoring American maritime dominance. Within the EO, the President called for the creation of Maritime Prosperity Zones—investment hubs modeled after the “highly successful Opportunity Zones concept.” While not directly mentioned in the EO, the program has the potential to leverage OZ incentives by targeting shipyards in designated areas, including the Mobile, Alabama submarine supplier yard that was recently tapped by the U.S. Navy.

- Quantum computing unicorn PsiQuantum has obtained a comprehensive incentive package totaling more than $500 million over 30 years, negotiated jointly by the State of Illinois, Cook County, and the City of Chicago, for them to build their utility-scale quantum computer there.

For decades, US enterprises have outsourced manufacturing to countries with cheap labor, and US private investors have pursued high growth without heavy capital, mostly in software. Without a doubt, America has lost its hardware manufacturing capabilities, which raises a national security issue. Taiwan, Japan, and Korea can help the US build up its manufacturing abilities and non-China supply chain. For Asian companies looking to invest in US manufacturing, forming an alliance to negotiate with governments could be a smart move.

An Introduction Deck to More about Prioritized Sectors, Interests of Local Governments

US Opportunity Zones Map, from U.S. Department of Housing and Urban Development