Demo Day

Demo Day is for select startups to present to the Global League, it is free for voted startups. We accept recommendations from investors or industry advisors only.

Currently, we prioritized these startups: climate tech with a capital-lighter strategy, AI infrastructure, semiconductors.

Quality

Recommendation

By industry advisors or quality investors

Readiness

Investment Ready

Checked or mentored by investors

Follow Up

Engagement and Workflow

By a digital platform with VC’s best practice

How We Work. Our Mission & Values

Angels or VCs can recommend startups or funds through the form linked below. We accept recommendations from investors or industry advisors only. Investors are expected to share why they have backed the companies/funds they recommend, and how have they been doing (key milestones or revenues, etc.). Startups may invite their investors to recommend them. And, we always keep studying quality deal sources.

We will go through a process to align considerations for monthly demo events – in quality, readiness, investability, emerging opportunities and interests. We need to collect enough interest to invite a startup to Demo Day, it’s free for invited startups (as our community service), so we’ll invite you to vote. This isn’t the normal Demo Day you usually see, the purpose is to enable the communication needed for catalyzing investments in startups voted to present, only ONE startup for a meeting (20 min. presentation + 40 min. Q&A). We might reach out to relevant investors or strategic partners to broaden the reach to help impactful ventures.

Make A Recommendation

Who should we help to get funded for a meaningful impact as well as for a profit?

Climate Tech

Enabling IP/tech, keys for adoption bottlenecks or efficiency, capital-lighter strategy

Semiconductor

Sustainability, digital transformation with AI, optics or photonic electronics

Medical Innovations

Platform technology enabling disruptive solutions not in crowded sectors, enabling tech with semiconductor strength

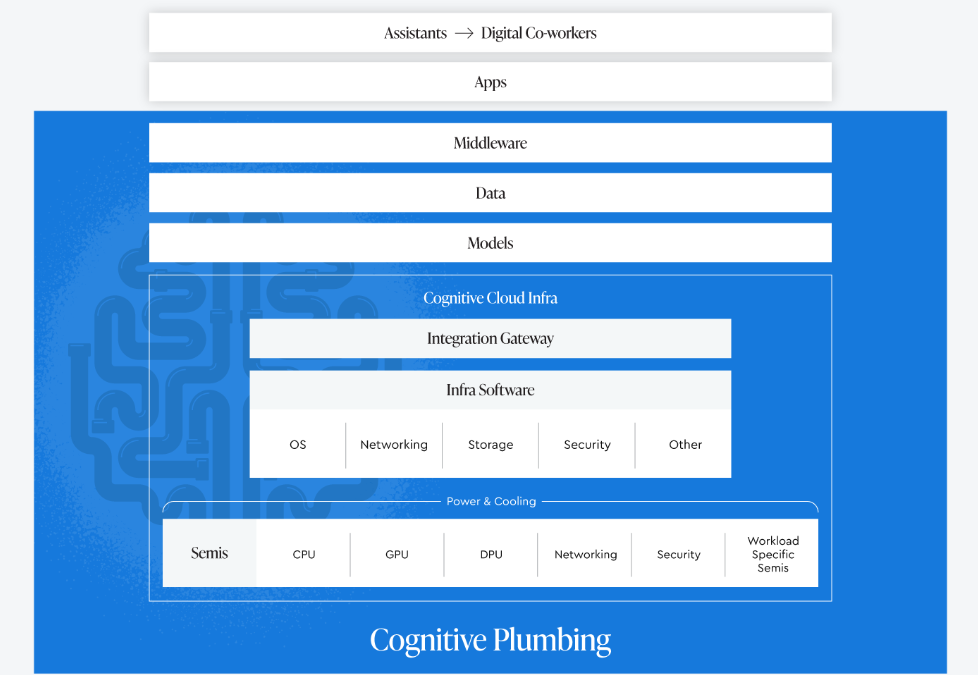

AI Infrastructure

Hardware or software stacks, AI specialized chip, sustainable computing

Vertical AI Applications

With the capability and moat of industry integration and expertise

Space and Sattlite Tech

Critical infrastructure elements, satellite internet, defense security related demands, convergence with AI, robotics, energy and data storage

Blog

What We Are Looking At

Market trends and our panels…

AI Infrastructure Hardware and Software Accrue the Most Value in AI Stack

AI share in the global VC funding keeps increasing, around $20B In February, more than a fifth of all venture funding in February went to AI companies, with $4.7 billion invested in the sector. That was up significantly from the $2.2 billion invested in AI companies...

AI Infrastructure Hardware and Software Accrue the Most Value in AI Stack

AI share in the global VC funding keeps increasing, around $20B In February, more than a fifth of all venture funding in February went to AI companies, with $4.7 billion invested in the sector. That was up significantly from the $2.2 billion invested in AI companies...

Magnificent Seven to Watch for the Next AI Era

In the 2024 Tech Trend published by CBInsights, the first to watch is GPU shortage (it has been for most of 2023). Nvidia hit a $1T market cap in Q2’23, its rise signals the next platform shift. The new term "Magnificent 7" big tech giants, was created by Bank of...

Water Innovations and Investments are Growing Strong

The investor panel recording on the water innovations (Jan.26, 2024). Thanks to all the panelists for the great conversation and the chat record is here. A suggestion from Paul Burgon, Exit Ventures - (he has a background in running the North American division of a...