Green Building Startup Investments at Record High in 2023

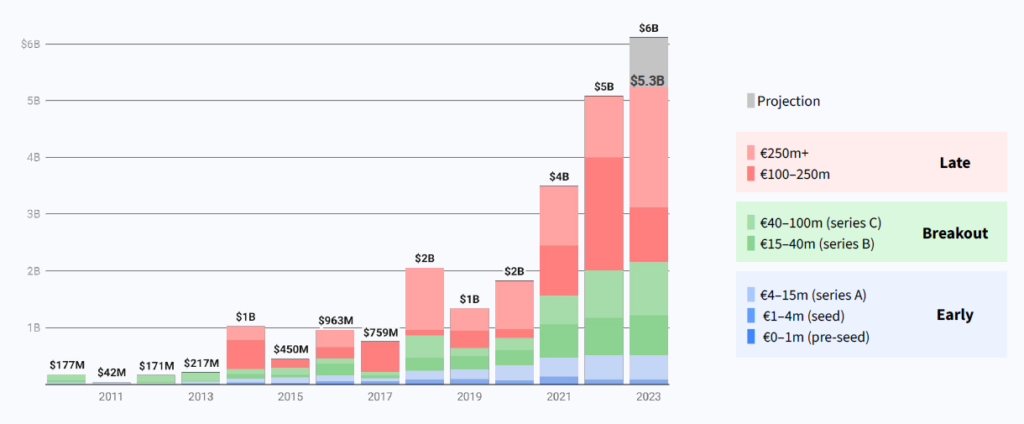

Global investment in clean energy had been on track to reach an all-time high in 2023 – $1.8T – according to IEA, $500 billion more than in 2022. And one of the agreements from COP28 is a commitment to triple the world’s capacity of wind, solar, and other renewable energy by 2030, concurrent with a doubling of the pace of energy efficiency gains. Although VC investments in climate tech decreased almost 40% YoY like the general trend, VC funding into green buildings had the best year ever in 2023 according to a report published by 2150 and Dealroom in 2023 November – Funding for green building startups is already at record high levels with $5.3B in 2023, projected to grow over 3x in respect to 2020, as below.

Chart from Urban Tech 2023 by 2150 and Dealroom (data as of 2023 November)

Policies

Policies worldwide are accelerating the transition to more sustainable cities with focus on building energy efficiency, heating and cooling.

The building sector is responsible for over 1/3 of total greenhouse gas emissions in Europe. Residential heating, in particular, accounts for the largest share of GHG emissions in buildings. The EU has now revised its Energy Performance of Buildings Directive (EPBD) and the Energy Efficiency Directive (EED) to transform the EU’s building stock as a main decarbonization lever. There are 4 key measures: (1) Energy Performance Certificates (EPCS), (2) Minimum Energy Performance Standards (MEPS), (3) Zero emissions buildings (ZEBS) – All buildings will have to receive a label D by 2033 and A by 2050. (4) Low Carbon District Heating – phase out fossil fuel heating by 2040.

US

In the United States, California passed a first-in-the-nation embodied carbon code for commercial buildings and schools (that RMI helped shape). New York became the first state to legislatively require all new buildings to be electric. In 25 US states, governors committed to installing 20 million heat pumps by 2030. Washington State passed building codes that will require new homes to provide energy-efficient heating and cooling. And Massachusetts passed a first-in-the-nation ruling that puts the state on a faster path to electrify heating.

New York City:

In New York City, Local Law 97 (LL97) imposes carbon caps and reductions on buildings larger than 25k square feet. Affordable Housing Buildings that include affordable and rent-regulated housing are not exempt from the requirements of Local Law 97, but they may be treated differently. Many components of the bill will be phased in gradually beginning in 2024. Carbon restrictions will be tightened during a series of compliance periods until 2049. By 2050, all buildings must meet zero-emissions standards.

Opportunities

Planet A Ventures pointed out these opportunities are noteworthy: (1) Digital tools for life-cycle energy audits of buildings, (2) Technologies and service providers for renovations, (3) Technologies for recycling and low-carbon materials, (4) Technologies for low-carbon heating.

In the Urban Tech report from 2150 and Dealroom, it’s highlighted that the biggest subcategories (in terms of funding) of Urban Tech unicorns are sustainable building construction and building energy efficiency companies. VC funding in both subcategories had kept growing in 2023 despite of the cooled VC investments. Overall there are 4 subcategories summarized in the report; enable, experience, build, and operate.

Enable: SaaS x construction startups have suffered a whopping 68% decline in VC funding despite the construction industry productivity challenges. VC funding for construction SaaS startups peaked in 2021.

Experience: Driven by real-world events, startups aiming to prevent and combat wildfires have raised over $100M in VC funding, on par with 2021 records, and grown 7x since 2018.

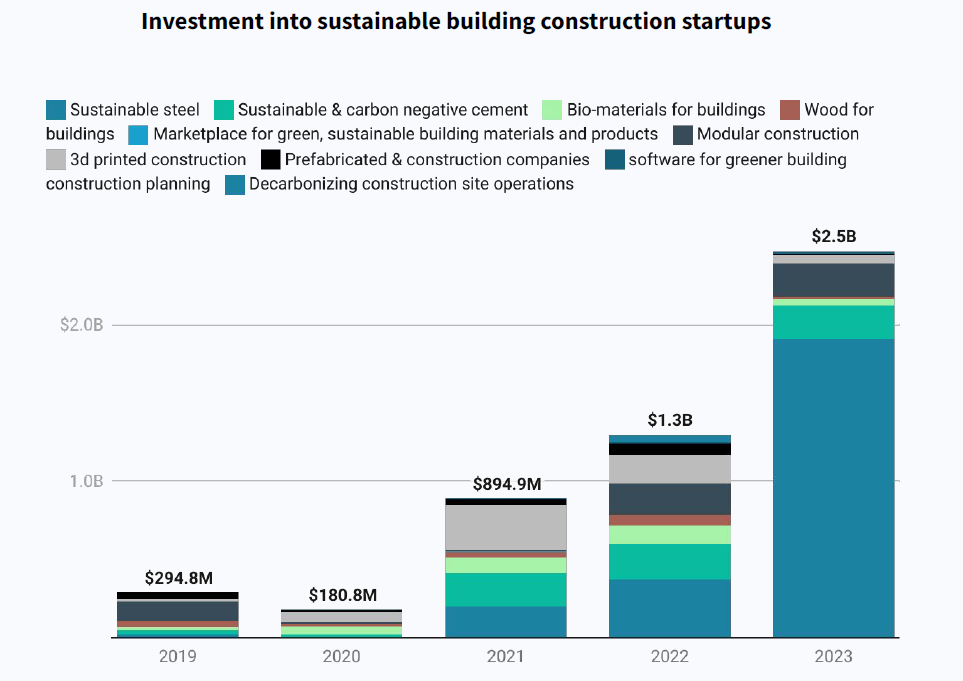

Build (planning, materials, construction, and processes): Sustainable building construction startups have raised a record $2.5B in 2023, far more than ever before, driven by materials innovation such as sustainable cement and green steel.

Source: Dealroom

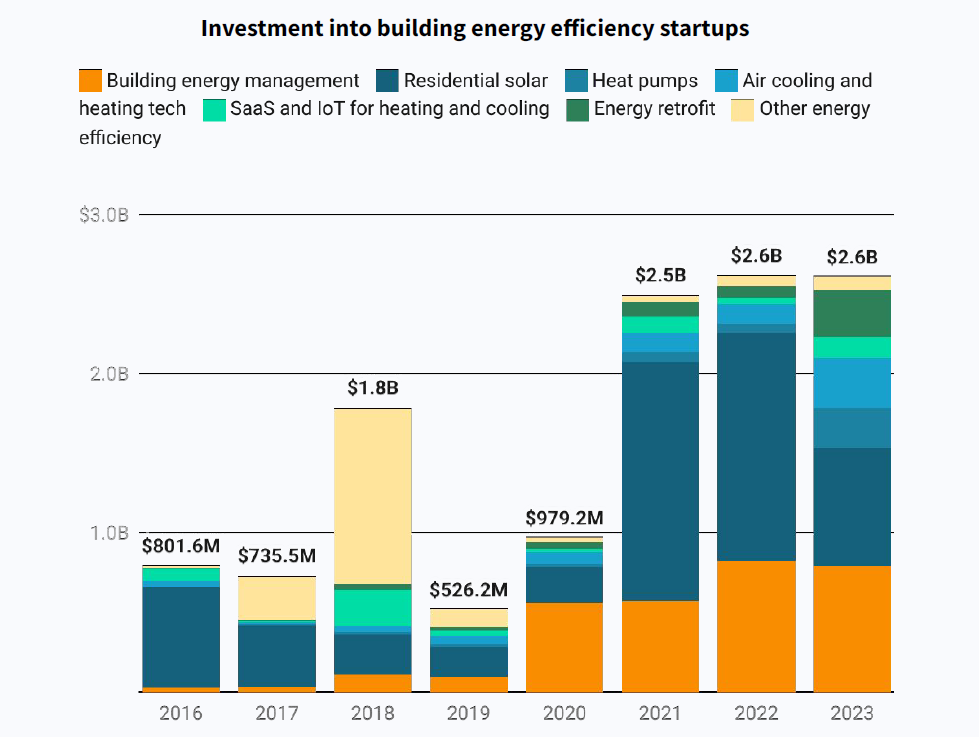

Operate (sensors and platforms to monitor, manage, retrofit, and optimize buildings and energy efficiency): Building operation decarbonization startups had their best year with $2.6 already raised, on track for a record of over $3B, led by building energy management and residential solar. Heat pumps and energy retrofits have also shown strong growth.

Source: Dealroom

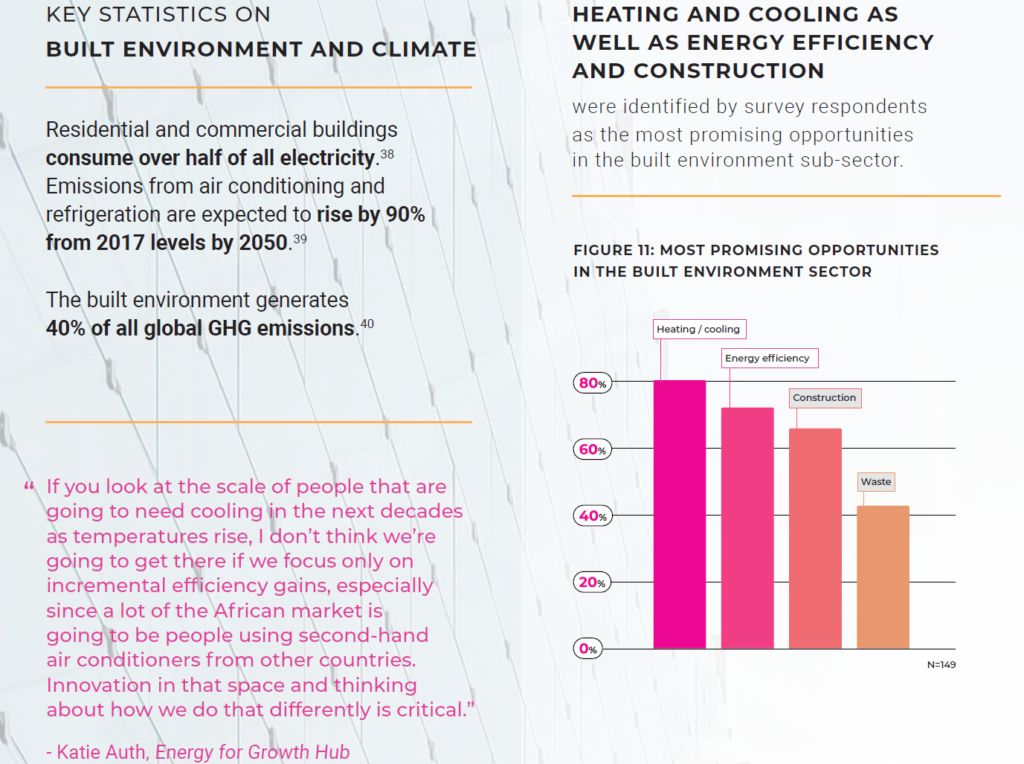

According to Oxford Climate Initiative’s report, the top 3 opportunities in the built environment are (1) Heating and cooling, (2) Energy efficiency, (3) Construction.

Image from the Oxford Climate Tech Initiaitve 2023 report

In 2023 September, a consortium of US states and territories representing more than half of the US economy announced a commitment to collectively reach 20 million residential electric heat pump installations by 2030. At least 40 percent of benefits flow to disadvantaged communities. (more on RMI) In 2023 November, the U.S. Department of Energy (DOE) announced a historic $169 million for nine projects to accelerate electric heat pump manufacturing at 15 sites across the US. The selected projects are the first awards from DOE’s authorization, invoked by President Biden using emergency authority on the basis of climate change, to utilize the Defense Production Act (DPA) to increase domestic production of five key clean energy technologies, including electric heat pumps.

Heat recovery/reuse is another opportunity. Some cities have built underground networks that can reuse heat from facilities like industries, data centers, and wastewater treatment centers to heat other buildings and tap water. These cross-sector heat recovery systems, are called heat networks. (read more) Furthermore, cooling is expected to be a significant contributor to energy use in the future, foreseen to triple in demand globally by 2050. Through COP28 over 60 countries signed up to a so-called ‘cooling pledge’ with commitments to reduce the climate impact of the cooling sector, which could also provide “universal access to life-saving cooling, take the pressure off energy grids and save trillions of dollars by 2050.” At the same time, conventional cooling, such as air conditioning, is a major driver of climate change, responsible for over seven percent of global greenhouse gas emissions. (more on UNEP-led ‘Cool Coalition’)

On the other hand, we’ve covered Distributed Energy Resources (DER), Virtual Power Plants (VPP) and Net Zero Energy Home in this previous panel on energy transition infrastructures. In our conversation with Maria Atkinson of Nirman Ventures, a construction and cleantech-focused VC, she pointed to the same opportunities:

Any tech that helps with the coordination of dynamic energy flows and the efficiency of buildings is needed. A new market and exciting opportunity for real estate and construction is playing in the energy sector! While the energy transition discussion often focuses on the utility-scale transition, the spotlight is growing on the critical role of a lower-cost, lower risk approach which puts buildings and the building sector front and center.

Consumer Energy Resources is an area of untapped opportunity that will continue its growth trajectory in coming years, encouraged by high grid prices. The ongoing high uptake of solar and batteries should see the capital costs of these technologies continue to decline. With that will also come a higher uptake of enabling technologies like smart meters, and smart devices that help with efficiency.

All of this represents an exciting opportunity for the building and construction sector to use its skills, services, and assets. Our industry, across all tiers, will increasingly be required to enable this ongoing customer-led transition. Where once the distribution companies held out against the two-way flows of electricity and the advent of “Prosumers” – those of us who generate more than we need – governments and electricity industry captains now have a sense of the opportunity that comes with being at the heart of this transition, and they need our help. More importantly, the time isn’t coming, it’s here.

We also reached out to Canada’s largest climate tech seed fund – Active Impact Investment. One of their theses is “Adapting and monitoring the built environment to efficiently use energy and other resources without sacrificing services.” One investable whitespace they highlight:

As the demand for clean energy grows, we see exciting investment opportunities in software and sensors to support the transition: a 60GW virtual power plant (VPP) could meet future resource needs at a net cost $15-35B lower than the cost of new generation. VPPs connect multiple energy generation and consumption assets in real-time to shape the electricity load—saving energy costs by 40-60% while increasing grid resilience.

We continue to see opportunities in energy retrofits and automation systems, which can save 10-40% in energy costs and are expected to be a $273B market by 2032. We also see investable whitespace in companies that create efficient extraction techniques and reuse systems for precious metals–which will require $250-$350B in capital expenditure by 2030 to support the growing demand for renewables, energy storage, and EVs.

As Active Impact Investment pointed out: “39% of global emissions come from construction & the built environment, 30% of the energy used by buildings is wasted. Between 2015 and 2020, power outages had increased 60% due to grid unreliability.” There are big opportunities behind decarbonization and sustainability of our built environment.

On Jan. 12, 2024, our ClimateTech Investor Panel will invite/welcome investors, industry experts, and entrepreneurs to have a discussion on this topic. We’ve invited Zohaib Dar, Consultant of EY specializing in energy transition and digital transformation of built environments with first-hand experience with corporate venture and innovation programs, and Jessie Chuang the coordinator of Global League, to moderate the discussion. Everyone can introduce themselves, we love to see a more interactive networking and exchange event. (Learn more about Global League)

Questions to discuss:

- What are investors looking for (investable whitespace)? Which sub-sectors of the built environment have the most promising potential or are underinvested? What sub-sectors are too crowded?

- How do investors identify and evaluate investments?

- How about policies and incentives that encourage or mandate the adoption of low-carbon technologies and practices, such as carbon taxes, subsidies, standards, and credits?

- What are the risk factors of investing in this built or urban tech space? How could we help de-risk them?

- Introductions of promising innovations and startups (by investors or advisors)

Join the meeting or get the recording

Note: To share your opinions by email, email them to Partner@wiseocean.g-l.ventures, we’ll gather shared insights or news in Global League newsletters for our network. (Subscribe to Newsletters)